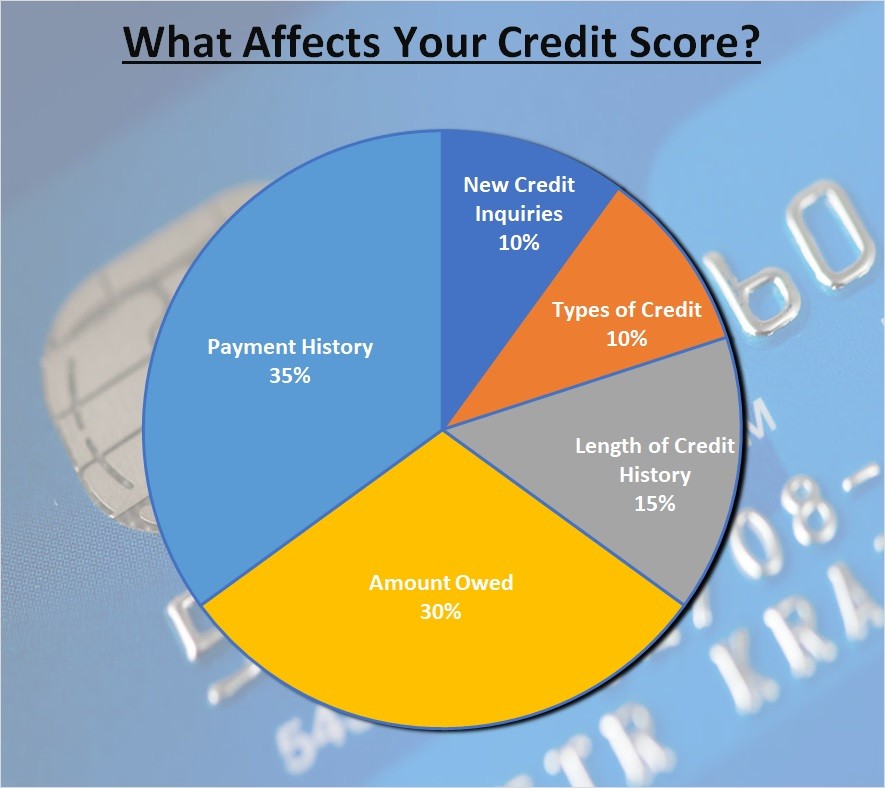

Have you ever wondered what really affects your credit score? Did that late car payment really make a difference? Does having too many companies ask about your credit rating, affect the rating? Well, here are the answers:

1 – PAYMENT HISTORY = 35%

Making payments on time is the most important.

2 – AMOUNT OWED = 30%

Obviously your credit score is heavily affected by the amount you owe relative to your net worth.

3 – Length of Credit History = 15%

This one has a twist. Most agencies only keep track of the last 6 years of credit, which means it takes 6 years to get a good rating for the history portion of your credit score. It also means credit “problems” older than 6 years make little or no difference to your credit score.

4 – Type of Credit = 10%

Mortgage credit is considered “good credit” and high interest loans or credit card debt is considered “bad credit”.

5 – New Credit Inquiries = 10%

This one is a bit tricky too, because a single ‘credit inquiry’ is considered as any credit inquiries within 14 days. If you have many credit inquiries, credit rating agencies think you have some sort of problem and score you poorly. This means, if you want to get credit, get all of the inquiries done in within 2 weeks.

2 Comments

Lucinda Watson · April 6, 2021 at 10:05 pm

Thank you for sharing superb information. Your site is very cool. You, my friend, ROCK! I found simply the information I already searched all over the place and simply could not come across.

Fidela · September 17, 2021 at 3:36 am

Hiya, I am really glad I’ve found this information. Most sites publish only about gossips and net and this is irritating. This explains why my credit score was so good while my sisters was so bad. This is what I need. Thanks